- support@locusassignments.com

Unit 9 Management Accounting Costing and Budgeting Assignment

|

Program |

Diploma in Business |

|

Unit Number and Title |

Unit 9 Management Accounting Costing and Budgeting |

|

QFC Level |

Level 4 |

Introduction

Unit 9 management accounting costing and budgeting assignment helps you in providing an in-depth knowledge about different costs involved in a running business. By going through this, students will able to know what are the tools or techniques followed by the business to analyze the cost and prepare the cost reports of the organization. The problem solving assignments also help them in understanding and taking different decisions related to costing and budgeting.

Task 1

Every organization follows the cost structure involved in the business in order to reach the goals and run the business successfully. For this the organization needs to understand and classify different cost under different overheads and also specific needs to pay interest in making different cost reports and budgets of the business process.

P 1.1- Different types of cost

Here we have taken into consideration the manufacturing unit of Buccaneers Ltd. in our case study. Below mentioned is the classification of costs based on information related to Buccaneers Ltd (Farr, 2011).

Before going to the types of cost let us understand what cost actually is. The word cost denotes the real amount of money that a company spends on the creation of goods and services which include expenditure on raw materials, equipments, supplies, services, labour, products, etc.

Cost is mainly classified into three main elements:

- Materials – Direct/Indirect

- Labour- Direct/Indirect

- Expenses- Direct/Indirect

Based on these elements cost can be divided into Product cost and Period cost.

- Product cost – These are cost of manufacturing the product.

- Period cost – These involve the costs apart from the manufacturing cost which are charged to or written off to income statement during different periods.

- Product cost- Product cost includes ‘Direct cost’. Direct cost are those which are directly associated with manufacturing of products (Tyran, 1982). These costs are generally variable costs. Direct cost includes the following:-

- Direct Material – These are the cost which is incurred during manufacturing of a product, such as directly on raw-materials. Example, cost incurred on plywood, fabric for textile, wooden battens, steel for almirah etc.

- Direct Labour – These are production or service labour that are assigned to a specific production or cost centre. Example, drillers, painters, sawyers, assemblers, etc.

- Direct Expenses – According to IAS 2(International Accounting Standards) direct expenses is a part of the cost structure. These are those expenses which are incurred on a product for either improving their quality or design. Example, special machinery is bought to upgrade the style of tables and chairs (Farr, 2011).

Thus, total of direct costs are known as Prime Cost and Product cost is the summation of Prime Cost and Overheads,

Product Cost = Prime Cost + Overheads.

Indirect Cost- The indirect cost includes the cost which are incurred in the factory but not directly incurred on manufacturing of a product (Rouwendal, 2012). The indirect cost includes the following:

- Indirect Material – The costs which have not been included in direct material will come under indirect material.

- Indirect Labour – The cost of labour which are indirectly associated with the manufacturing are indirect labour cost. Example, managers, supervisors, technicians’ cleaners, etc.

- Indirect Expenses – The indirect expenses mainly involves the factory cost. Example, depreciation on machinery, electricity cost, rent, telephone bill, council tax, insurance, etc. These basically include the Overhead costs.

Period cost- Period cost is the cost that includes Administrative cost, Selling and Distribution cost and Finance cost.

- Administrative cost – These are the cost which includes the administrative expenses of the organization. The administrative cost includes salaries of employees, office rent, Council tax, water cost, telephone bill, etc (Farr, 2011).

- Selling and Distribution cost – These are the costs incurred for making products qualify for selling and several distribution activities undertaken. These cost includes cost of advertising, market research, survey, salaries, bonus, etc.

- Finance cost – These costs are those which are associated with permanent, long-term and short-term finance. This cost includes dividend, interest, long term and short term loans, etc.

Cost can be further classified on the following basis:

Based on behaviour: Based on behaviour the costs are divided into 3 types they are fixed cost, variable cost, and semi variable cost.

- Fixed costs: The cost that remains constant even if the activities of business changes. It does not have any effect on production level (Underwood, 2006).

- Variable costs: These are costs which will vary according to the production level of the Buccaneers Ltd (Czopek, 2004).

- Semi variable costs: The costs which have both the characteristics like fixed and variable costs.

Based on controllability: Based on controllability the costs are divided into 2 types one is controllable which is controllable by the business management and another which is not controllable by the management.

Based on time: Based on timing the costs are classified into 2 types one is historical costs and Predetermined cost.

- Historical costs: The cost which is prepared in past and followed by present.

- Predetermined cost: The cost which is prepared in advance for future purpose (Rouwendal, 2012).

P 1.2 –the different costing methods

There are different types of costing methods which are followed by an organization. In order to run the business successfully in typical situations. They are as follows:

- Job costing: This method is followed by the industry having different types of jobs and cost of each job can be calculated by this method. For example, a builder who provides service to householders, factory owner, shop owner, etc (Lucey, 2002).

- Contract costing: This method is used to calculate the cost of specific venture or contract like cost incurred in building bridges, buildings etc.

- Process costing: This method is used by the organization which follows different process in order to make the finished products. For example in textile industries to make finished product (cloth) they follow different process like spinning, weaving, colouring, folding etc. so the cost can be separately calculate by this product (Harris, 1995).

- Service costing: This method is suitable for the service oriented business. For this separate costing method is formulated for the benefits of the service organization (Baum, 2013).

In case of Buccaneers Ltd. Job costing method has been used to ascertain the cost of the specific job given in this case study.

P1.3 - How is the cost calculated, using appropriate techniques? What is the costing technique used to calculate its costs

Marginal costing: This technique is used by the organization when it wants to produce any extra unit. According to this method variable cost is charged on the individual product and fixed cost will be written off in the income statement of the organization (Harris, 1995).

The given equation below is used to derive the Marginal Cost:

Marginal Cost = Fixed Cost + Variable Cost.

Absorption costing: Absorption accounting is a part of management accounting cost method. It is the manufacturing cost which is absorbed by the units produced. This cost can be fixed or variable which are apportioned to different cost centres where they are accounted for absorption rates (Rouwendal, 2012). By using this method cost incurred is recovered from the selling price of goods and or services. This technique includes cost related to the production and which are directly charged to the products and services.

As per assignment absorption costing has to be used to find out the solution to the problem of Buccaneers Ltd.

P 1.4- Analyse the cost data of the org focusing on the technique used for the purpose

Allocate and apportion overheads to the three production departments

|

|

Indirect material |

Indirect labour |

Maintenance costs |

Rent and rates |

Heating and lighting |

Building insurance |

Machinery insurance |

Depreciation of machinery |

Sub totals |

Administration |

Total Overhead |

|

|

Basis of apportionment |

Given |

15:75:10 |

20:15:10:5 |

20:15:10:5 |

20:15:10:5 |

5:15:5 |

5:15:5 |

|

Direct labour cost (180:120:75) |

670.00 |

||

|

Forming £000 |

40 |

80 |

7.5 |

40 |

8 |

4 |

2 |

24 |

205.5 |

39.84 |

245.3 |

|

|

Machining £000 |

30 |

70 |

37.5 |

30 |

6 |

3 |

6 |

72 |

254.5 |

26.56 |

281.1 |

|

|

Finishing £000 |

10 |

60 |

5 |

20 |

4 |

2 |

2 |

24 |

127 |

16.6 |

143.6 |

|

|

Administration £000 |

10 |

60 |

0 |

10 |

2 |

1 |

0 |

0 |

83 |

-83 |

0 |

|

Workings:

|

Maintenance costs (Time) Forming department 15% x 50 = 7.5 Machining department 75% x 50 = 37.5 Finishing department 10% x 50 = 5 |

Rent and rates (Total floor space= 50,000) Forming department 20/50 x 100 = 40 Machining department 15/50 x 100 = 30 Finishing department 10/50 x 100 = 20 Administrative dept. 5/50 x 100 = 10 |

|

Heating and lighting (Total floor space= 50,000) Forming department 20/50 x 20 = 8 Machining department 15/50 x 20 = 6 Finishing department 10/50 x 20 = 4 Administrative dept. 5/50 x 20 = 2 |

Building Insurance (Total floor space= 50,000) Forming department 20/50 x 10 = 4 Machining department 15/50 x 10 = 3 Finishing department 10/50 x 10 = 2 Administrative dept. 5/50 x 10 = 1 |

|

Machine Insurance (Total machine hours =25,000) Forming department 5/25 x 10 = 2 Machining department 15/25 x 10 = 6 Finishing department 5/25 x 10 = 2 |

Depreciation of machinery (Total machine hours =25,000) Forming department 5/25 x 120 = 24 Machining department 15/25 x 120 = 72 Finishing department 5/25 x 120 = 24

|

|

Administrative cost (Total direct labour cost =375,000) Forming department 180/375 x 83 = 39.84 Machining department 120/375 x 83 = 26.56 Finishing department 75/375 x 83 = 16.60 |

|

B. Deduce overhead recovery rates for each department using two different bases for each department overheads.

|

Departmental overhead recovery rate |

Using machine hours |

Departmental overheads / Machine hours |

|

Using labour hours |

Departmental overheads / labour hours |

Forming department

Using machine hours £245,340/5,000hrs = £49.07 per machine hour

Using labour hours £245,340/30,000 = £8.18 per labour hour

Labour hours = £180,000/£6 = 30,000hrs

Machining department

Using machine hours £281,060/15,000hrs = £18.74per machine hour

Using labour hours £281,060/20,000 = £14.05per labour hour

Labour hours = £120,000/£6 = 20,000hrs

Finishing

Using machine hours £143,600/5,000hrs = £28.72per machine hour

Using labour hours £143,600/12,500 = £11.49per labour hour

Labour hours = £75,000/£6 = 12,500hrs

C. Calculate the full cost of a job with the following characteristics for the information in the case study

|

Job cost |

||

|

|

£000 |

£000 |

|

Direct material costs – |

|

|

|

Forming dept |

40 |

|

|

Machining dept |

9 |

|

|

Finishing dept |

4 |

|

|

Total material cost |

|

53 |

|

Direct labour costs – |

|

|

|

Forming dept 4hrs x £6 |

24 |

|

|

Machining dept 4hrs x £6 |

24 |

|

|

Finishing dept 1hr x £6 |

6 |

|

|

Total labour cost |

|

54 |

|

Overhead costs – |

|

|

|

Forming 1hr ´ £49.07 |

49.07 |

|

|

Machining 2hrs ´ £18.74 |

37.48 |

|

|

Finishing 1hr ´ £28.72 |

28.72 |

|

|

Total overhead cost |

|

115.27 |

|

Total job cost |

|

222.27 |

D. Explain why you consider the basis used in (c) to be the more appropriate

The machine hour rate has been used to allocate the overheads as machine hour rate has a more rational approach. The machine hour rate is free from bias and at the same time machining expenses are major contributors to the overall expenses (Rouwendal, 2012).

Contact us

Get assignment help from full time dedicated experts of Locus assignments.

Call us: +44 – 7497 786 317Email: support@locusassignments.com

Task 2

P 2.1- What are the various performance indicators used to identify its potential improvements

Performance indicator is a type of measurement scale that is used to evaluate the success of an organization.

The various performance indicators used by business to measure the performances are:-

1. Balance scorecard- it is the most important tool used to measure the performance as it includes both financial and non-financial measures. It measures the strategy of the organization.

2. Financial measures- It includes gross profit margin, net profit margin and operating margin.

- Gross profit margin is a financial metric used to measure the firm’s financial health by identifying the proportion of money left over from revenues after accounting for cost of goods sold. In simple words, it is the difference between revenue and cost before accounting for other cost. This metric helps not only to estimate the firms health but also helps to compare the firm’s position with its competitors.

Gross profit = Revenue (Sales) – Cost of goods sold.

- Net profit margin- It is the percentage of revenue that remains after deducting operating expenses, interest, taxes and preferred stock dividends from total revenue (Wilkinson, 1999).

- Operating margin- It is used to measure the efficiency of the firm. The higher operating margin indicates more profit.

Non-financial measures- it includes customer satisfaction , number of units manufactured, goodwill, etc. Customer feedback plays a crucial role as positive feedback shows an improvement and negative shows the opposite.

P 2.3- If you were their Management accountant what would you suggest to reduce its costs, enhance value and quality?

Cost reduction refers to the actual reduction on the cost of goods manufactured and services delivered. These costs can be reduced in two ways:

- By reducing the unit cost of production

- By increasing productivity

As a management accountant I would suggest the following methods to reduce cost and enhance value and quality:-

- Target costing- target cost determines the actual cost price of a product from which we can earn profit.

Target costing=Expected selling price-desired profit

- Value engineering- it is an advance form or technique used in the process of reducing cost. It can be applied in the areas of manufacturing, production, development, design and construction.

- Economic order quantity- A quantity that minimizes the ordering and carrying cost of inventory (Wilkinson, 1999).

- Activity based management- It does not focus on controlling cost rather it aims at controlling the activities involved with cost. As controlling the activities help in managing the cost in the long run.

- It aims at producing the required item with the required quality and quantity at the time of need. It helps in reducing cost by-

- Zero inventory

- No defects

- Single batch ordering; it saves time and effort.

- Avoiding non value added activities

- Total quality management- TQM helps to reduce cost by producing a good quality product in the first time without wasting the resources and by avoiding extra expenditure incurred on inspection, scrapping and rework (Wilkinson, 1999).

Task 3

P 3.1- Explain the purpose and nature of the budgeting process adopted

Budget – As future is uncertain; so budget is prepared to overcome this uncertainty. Budget is a plan made for future. In other words, budget is a financial plan of probable expenditure and income for a defined period of time.

Purpose of budgeting process-

The three most important purpose of budgeting process includes the following:-

It acts as a tool:

To forecast income and expenditure – budgeting is an important part in the planning process of the business (Grabski, Leech and Sangster, 2009). Here, the managers should be able to predict whether the business will make profit or loss. For the success of a business, the expenditure part should be tightly controlled.

For Decision making – Budgeting provides a financial overview for the decision making process. For example, in a manufacturing business, the budget shows how much to expend on the production of any product.

To monitor business performance- Budgeting helps to measure the actual business performance with the estimated one. It shows whether the business is living up to the expectation or not (Grabski, Leech and Sangster, 2009).

Other purposes of budgeting process includes:-

- Budgeting is necessary for survival of the business as it stops the managers to rely on poorly coordinated planning.

- Actual result is compared with the budgeted one which provides a base to take further action.

- Budgeting is a formal way of communication between the mangers of different level.

- Budget motivates the managers to achieve their goals.

- Allocation of resources

- Evaluating manager’s performance

Nature of budgeting process-

- Estimate the financial environment on the basis of last budget.

- Helps in determining the probable amount of revenue that can be generated from sales.

- Defines the required expenditure such as raw materials, production cost, advertisement expenses (Grabski, Leech and Sangster, 2009).

- Then, subtracting estimated expenses from estimated revenues.

- Then after reviewing, the final budget is submitted.

P 3.2- What is the budgeting method used for the case study and reflect its needs. Comment with your advice and suggestions

There are different types of budgeting methods such as:-

- Zero based budgeting- it is suitable for public sector organization. It starts with a baseline of zero instead of a baseline of last year’s budget.

- Activity based budgeting- it is based on activity. The volume of an activity is taken into consideration instead of any historical evidences.

- Bottom to up approach- it starts with the lower level. Here, lower level gets the opportunity to make the budget and have their opinions.

- Top down approach- the approach starts with the top level of the management. The top level mangers provide the guidelines to the lower level employees on how to calculate the budget.

- Incremental budget- it is more suitable for stable business. it starts with last year’s budget from where an amount is added or subtracted in order to avoid inflation.

- Periodic budget - A periodic budget is the one where the budget is prepared for a specific period generally for a month, six months or a year as per requirement.

In case of Antonio Ltd. the company has asked us to prepare different budgets for six months on the basis of the information given at the beginning of the period. It is a Periodic budget.

Suggestion:- Here the company has purchased raw materials in advance without issuing it to the production department. So, the company should avoid this period of holding in order to reduce holding cost. The trade payable budget is showing that one month credit has been allowed by the suppliers, it should be increased as the liquidity position of the company is not so good. The cash budget is showing decrease in cash which should be taken into care by reducing the outflow of cash.

P 3.3- How is the budget prepared, what is the method used for this purpose. Comment with the budgeting statement for the chosen case study.

As we know budget is one of the quantitative expression of plan in a defined period of time. Budget is generally prepared for to purpose of attaining a particular financial goal such as reducing expenditure, increasing the savings etc. So in order to reach the goal of the organization one is to know the process followed to prepare the budget (Bowhill, 1995).

Generally budget is prepared on the basis of regular time period like on yearly or half yearly basis, on monthly basis, on quarterly basis, etc. After preparing the budget it is required to monitor and review the budget so that the organization will be able to obtain the benefit from the preparation of budget.

First and foremost thing in preparing the budget is that we should classify the important types of budget which is to be prepared by the organization. As per case the organization has to prepare raw material budget, cash budget and trade payable budget.

Raw Material Budget: Raw material budget can be prepared by taking historical data regarding raw material which have been used by the production department. This historical data will give the idea in estimating the quantity which is required in future.

Cash budget: To prepare the cash budget the organization must evaluate different cash inflows and outflows of the business like receipts of cash, payments of cash etc. (Bowhill, 1995). In order to evaluate the cash flows the companies need to go through different month’s cash received by the debtors and cash paid to creditor etc. This helps in estimating and preparing the appropriate budget.

Trade budget: This trade budget is prepared when the company is in risk and unable to pay money to the creditors. In such cases if the time given by creditors is completed then the company will start preparing the trade budget (Bowhill, 1995).

These are the different types of budget prepared by the organization to reach the objectives of the business and also to take some effective decision in making investment for the business.

P 3.4 – For the chosen case study of Antonio ltd draw up the following for the six months ending 31 December:

A raw materials inventories budget, showing both physical quantities and financial values.

|

Raw materials |

Production in units |

Raw materials purchases (units) |

Financial values (£) |

|

July |

500 |

600 |

4,800.00 |

|

August |

600 |

600 |

4,800.00 |

|

September |

600 |

700 |

5,600.00 |

|

October |

700 |

750 |

6,000.00 |

|

November |

750 |

750 |

6,000.00 |

|

December |

750 |

750 |

6,000.00 |

|

January |

750 |

|

|

Trade payable budget.

|

July |

600 |

500 |

4,800.00 |

|

August |

600 |

600 |

4,800.00 |

|

September |

700 |

600 |

5,600.00 |

|

October |

750 |

700 |

6,000.00 |

|

November |

750 |

750 |

6,000.00 |

|

December |

750 |

750 |

6,000.00 |

iii) Cash budget

|

Opening cash |

Sales (B) |

Payments to creditors(£) |

Advertisement |

Direct labor expenses |

Overheads |

Installment |

Total expenditure |

Closing cash balance |

|

|

July |

7,500 |

7,600 |

4,000 |

1,000 |

3,000 |

1,560 |

9,560 |

5,540 |

|

|

Aug. |

5,540 |

9,200 |

4,800 |

3,600 |

1,600 |

10,000 |

4,740 |

||

|

Sept. |

4,740 |

10,400 |

4,800 |

3,600 |

1,600 |

2,200 |

12,200 |

2,940 |

|

|

Oct. |

2,940 |

11,800 |

5,600 |

1,500 |

4,200 |

1,600 |

2,200 |

15,100 |

(360) |

|

Nov. |

(360) |

13,200 |

6,000 |

4,500 |

1,920 |

2,200 |

14,620 |

(1,780) |

|

|

Dec. |

(1,780) |

14,800 |

6,000 |

4,500 |

2,000 |

12,500 |

520 |

After taking into account the two months credit allowed for 40% of the sales amount and 60% of the sales affected for the current month the cash collection has been computed.

Cash outflow for overhead during the six months

|

Month |

Overhead |

Depreciation |

Cash expenses |

Actual expenses |

|

|

May |

1800 |

400 |

1400 |

|

|

|

June |

1800 |

400 |

1400 |

|

|

|

July |

2000 |

400 |

1600 |

1560 |

|

|

August |

2000 |

400 |

1600 |

1600 |

|

|

September |

2000 |

400 |

1600 |

1600 |

|

|

October |

2000 |

400 |

2000 |

1600 |

|

|

November |

2400 |

400 |

2000 |

1920 |

|

|

December |

2400 |

400 |

2000 |

2000 |

|

|

January |

2400 |

400 |

2000 |

|

|

Suggestion – the cash budget is showing cash deficit in the month of October and November. So, the management should avoid excess cash outflow by undertaking the benefit of lease financing.

Task 4

As every organization prepares the budget to estimate the cost involved in the project. It is prepared according to the capability of the business and necessity of the business. This budget should be compared with actual performance of the organization with estimated one. Obviously, there will be difference between actual performance and the estimated one (Drury, 1992). So the role of manager is to monitor and analyse the budget in order to find out the difference in amount and also to rectify the problem by decision making some changes in the budget.

The budget should be monitored on regular basis throughout the year. It may be yearly basis, half yearly basis, quarterly basis, or monthly basis. If the organization constantly reviews the budget it may help them in finding the solution of different problems.

So how often the organization monitors and reviews the budget will make the organization stay out of risk. If the organization falls in to different typical situation like unable to meet the debt obligation, shortage of turnover etc. In such cases there is a possibility of company to reduce the risk by making some changes in the long term budget. So for this the organization has to first find out the variance.

P 4.1 - How are the variances calculated?

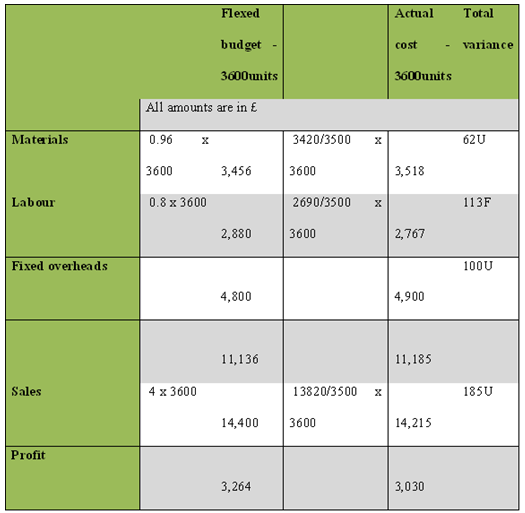

Material cost variance: (The table below has been prepared on the basis of table of variances calculated at the end)

Labour variance: (The table below has been prepared on the basis of table of variances calculated at the end)

Fixed overhead variance: (The table below has been prepared on the basis of table of variances calculated at the end) (Huitson, 1966)

Sales variance: (The table below has been prepared on the basis of table of variances calculated at the end)

Table of variances:

P 4.2 Reflect the operating statement to deduce the budgeted profit for may and reconcile it, through variances with the actual profit in as much detail as the information provided will allow.

Actual results of Toscanini Ltd.

Reconciliation statement:

P 4.3 Comment with the report findings and state which manager should be held accountable, in the first instance, for each variance calculated.

Material Usage: An adverse material usage points to the fact that the raw-material purchased was not of standard quality or in other words was of inferior quality. Adverse material usage also indicates excessive process loss which is of abnormal nature.

Labour efficiency: Labour efficiency can be gained through employment of skilled work force. This improves the productivity of the concern (Drury, 1992).

Sales price: The selling price has been forced to bring down compared to the budgeted level in order to market competition.

Fixed overheads: These include those overheads which are fixed in nature. In this scenario the company might need to go for external borrowing for which it has to pay interest.

Given what you know about the business performance for May. If it were discovered that the actual total world market demand for the business product was 10% lower that estimated when the may budget was set, explain how and why the variances that you identified in the above could be revised to provide that would be potentially more useful (Chadwick, 1998).

Conclusion

Finally from this unit 9 management accounting costing and budgeting assignment we came to know the importance of classifying the cost and evaluating the cost. What are the tools involved in while evaluating the cost. It also helps us knowing how one can find out the variance between actual cost and standard cost which helps in taking corrective measure in improving the performance of the organization.

Reference

Baum, M. (2013). Service business costing. Wiesbaden: Springer Gabler.

Bowhill, B. (1995). Why budgetary control systems fail. Engineering Management Journal, 5(6), p.284.

Chadwick, L. (1998). Management accounting. London: International Thomson Business Press.

Czopek, K. (2004). Fixed and variable costs. Krakow: Art-Tekst.

Drury, C. (1992). Standard costing. London: Published in association with the Chartered Institute of Management Accountants [by] Academic Press.

Farr, J. (2011). Systems life cycle costing. Boca Raton, FL: CRC Press.

Grabski, S., Leech, S. and Sangster, A. (2009). Management accounting in enterprise resource planning systems. Oxford: CIMA.

Harris, E. (1995). Marginal costing. London: Chartered Institute of Management Accountants.

Harris, E. (1995). Process costing. London: Chartered Institute of Management Accounts.

Lucey, T. (2002). Costing. London: Continuum International Publishing Group.

Assignment Help provide best quality assignment writing service in affordable prices and we are providing most flexible assignment writing according to Students need, so book your Assignment with us, order now Assignment Help UK

Need Help with Your Assignment?

Get expert guidance from top professionals & submit your work with confidence.

Fast • Reliable • Expert Support

Upload NowDetails

Other Assignments

Related Solution

Other Solution