- support@locusassignments.com

Unit 2 Finance in Hospitality Industry Assignment

|

Program |

Diploma in Hospitality Management |

|

Unit Number and Title |

Unit 2 Finance in Hospitality Industry |

|

QFC Level |

Level 4 |

Introduction

This Unit 2 Finance in Hospitality Industry Assignment will enable learners to develop practical understanding of the accounting techniques used to control costs and profits, and to support managers in making effective short-term decisions.

Task 1

1.1 Sources of funding available to finance the theme park project

Any capital project either it is opening a theme park or else establishing a factory or industry needs finance. As, finance is the breath of any business either it is a manufacturing business or a service industry i.e. hospitality industry. Whether to initiate a business or to run an already initiated business any industrialist needs money, capital, or we can say funds. The adequate amount of funds are needed in a business for various purposes like to purchase capital equipments and land to initiate business, employing experts and employees and labors and payment of their wages, various running and maintenance costs, and so on. (Hussain, 1989).Thus, it is very important for a business man to procure proper amount of funds for its business. To procure funds various options are available to him in the market. He can either procure it from:

- Internal sources of Finance

- External sources of finance

Its up to the owner of the business to choose appropriate source of finance according to its needs and considering various implications of sources like legal, financial implications, dilution of control or bankruptcy implications. Similarly, to initiate the Theme park project the government of Hong Kong may look ate following funding options:

Internal source of finance: The various types of financing options within the organization i.e. intra organizations are:-

- Retained Earnings: This option is generally practiced by growing firms. They have 100% retained policy. Retained earnings are referred to as the collection of funds by the organization i.e. collecting funds by not distributing it to the members as dividend.

- Working Capital Management: The funds used to manage the routine expenditure of the organization are called working capital funds. A business may generate funds by considering its working capital needs by:

- Increase in revenue: For any organization whether it’s manufacturing or the service industry the prime source of income is sales. And the sales of any organization are the factor of demand and supply conditions of the market. However, it is not in the control of the business owner either to increase or decrease the sales.

- Delay in making payments: By delay in making payment to the creditors and the parties to whom they are liable to make payments, the company may retain funds. But for any organization it is not in its favour to delay the payments of its creditors and lenders as it may fend the creditability of the business. So, we can’t suggest the organizations to delay the payment of their dues as for any business to increase, its creditability is the foremost and the vital thing.

External source of finance: The various sources of procuring of funds that are not within the organization are:

- Preference Shares: The preference share holders have the dual benefit of the repayment of capital on liquidation of the company as well as payment of fixed amount of dividend. They also contribute to the core capital base of the company.

- Right Issue of shares: It is a benefit given to the existing shareholders of the company. As compared to the hazels company use to face during the issue of normal shares, it is much easier to issue right shares. These type of shareholders are given the benefit to subscribe to the shares at concessional price but have to fulfil certain conditions prescribed by the company. Also the shareholders may renounce their right to subscribe theses share to some other person.

- Asset securitization: This procedure may contain any type of financial asset. It promotes liquidity in the market. It is a procedure where an issuer creates a financial instrument i.e. a security by making a pool of various financial assets and then marketing it to different investors in the market to invest. It takes the illiquid asset or the group of asset and converts them into financial security by financial engineering.

- Term Loans: Term loan refers to procuring funds from commercial and merchant banks and large financial institutions. It consists of periodic interest charge that is to be paid on top of the principal sum due.

Factors to be considered to decide the final source of finance:

- The cost factor of each source of finance: Either it is any source of finance; cost is always associated with it. We can’t imagine a source of finance without cost. Foe e.g. if we talk about loans the payment of interest is the associated cost with it. Among all the sources of finance the cost of loan and debt is the most, either it is equity of working capital finance or else. Thus, the government of Hong Kong may consider the cost of particular source of finance before choosing the correct option.

- The exigency of funds: As compared to the external source of fiancé the internal source of finance mainly works upon the principal of accumulation. Thus, if we need immediate funds we may go for internal source of finance. If the purpose is not solved by the internal source of finance then we may go for external source of fiancé. Thus, the government may peep into the balance available into the accounts and then opt for external source (Holtz, 1983).

- The amount of money needed: this is one of the major factors to choose the appropriate source of funds. As external source of funds have wider scope as compare to internal source. Thus, when it is needed to finance large projects then the company may go for the external source of finance and for small projects it can go for small projects.

- The control of the business: Equity share holders have voting rights so they have control over the management of the organisation on the other hand debt holders do not have any role in the management. So while procuring finds from the various sources of finance the government of Hong Kong must consider this factor as it may dissolve the control of the business.

1.2. Different (possible) sources of income for theme park

A theme park industry has various sources of income available to them like:

- Admission Price

- Food safety and drink

- Merchandise

- Games

- Parking

- Sponsorship

The primary source of income available to the theme park industry is the admission price. It constitutes up to 50% to 60% of the total revenue. It also decides the percentage of other sources of revenue. As more the Guests admissions, more will be the food and drinks and merchandise purchased by them and more will be the games played by them and thus, higher will by the parking and other facilities used by them and higher will be the concession charges paid by them and thus, generating higher revenue for that Theme Park. This makes a theme park more popular and high cash generating cash cow which attracts various sponsors which will increase the sponsorship funds percentage. So, it is the primary source of income for the theme park industry. Since the huge amount of revenue of theme park can be generated from the receipt of admission charge, the theme parks could have presumed various admission pricing options to generate revenue on large scale from various different market segments. Merchandise sales, games, parking and other sponsorship, etc. source accounts for approximately 6% to 10%, 4% and 15% respectively.

Contact us

Get assignment help from full time dedicated experts of Locus assignments.

Call us: +44 – 7497 786 317Email: support@locusassignments.com

Task 2

2.1. Cost classification

- Direct cost: The cost which is directly attributable to the product is called as direct cost. The direct costs incurred by the Icon and Upper house are Room rent, Cashier and Receptionist’s salary, Interior decorators fees etc.

- Indirect cost: The cost which is not directly attributable to the product is called as indirect cost. The various indirect costs incurred by the hotels are Wifi charges, Taxi charges, snacks and soft drinks charges and other maintenance charges.

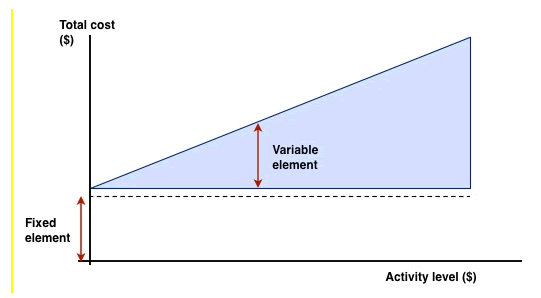

- Fixed costs: Those costs which remain fixed with the change in output and time is called fixed cost. The fixed costs of these hotels are salaries to receptionists and cashier, Interior decorator’s fees, wifi charges, etc.

- Variable costs: Those costs which vary with the change in output and time is called variable cost for the hotel like: Room rent, the more the guests the more will be the room rent, Taxi charges (the more guests come the more they pay taxi charges) etc.

2.2. Computation of cost variables

(a) Calculation of Breakeven level of output:

(b) The total amount of profit made by the souvenir shop last year by selling puppets are:

(c) The no. of puppets to be sold to achieve the profit of £50000 is 22,500 units.

(d) Limitations of CVP analysis

Although CVP analysis helps a lot to the management of the business in various analysis as it is easy to calculate, understandable, gives accuracy, helps management in decision making but still it has some limitations as it works on certain limitations which are not practical and thus, makes it disadvantageous. Certain assumptions of CVP analysis are:

- It works on the assumption that with the change in volume or we can say output there is no change in selling price per unit or variable cost per unit. (but actually due to economy of scale they tend to change).

- The concept of CVP analysis works on the assumption that the fixed cost of aby business does not change with change in time but this concept is correct in short run, in long rung the fixed cost tends to change.

- One of its assumptions is that any company will operate either for the single product or for a particular product mix constantly which is not practical. For example, if we take an example of a restaurant it tends to sell large quantity of hot drinks during winter as compared during summers, which may have different costs associated with them. If any company changes the mixture of products sold frequently or keeps large variety of products, then CVP analysis may not work in that condition (Lucey, 2008).

2.3. Pricing strategies that can be followed by icon and upper house

The various pricing strategies to be followed by the Icon and Upper house hotels may be:

- Penetration Pricing: In such type of pricing strategies, they tend to reduce price of the products and services of the company very low as compared to their competitor so that the large no. of users gets attracted. And later the price is increased once the objective is achieved.

- Premium Pricing: In this strategy they charge a high price for the unique product and services. For e.g such high prices may be charged by Icon and Upper house for luxuries such as cruises, Hotel rooms and flights. They can use this approach where a constitutive competitive advantage exists (Drysdale,2010).

- Price skimming: when the Hotels have a constitutive competitive advantage, they use to charge a high price of their products. However, the advantage is not constitutive. Thus, the high price leads to attract new competitors into the market, and due to increased supply the price necessarily falls.

- Psychological Pricing: This approach is used by Icon and Upper house when the marketer wants the consumer not to respond on rational basis which it mostly tend to but on emotional basis

- Product Line Pricing: When the hotels have a range of product or service for e.g various room rents or products then it charges different prices for different products and services. For example: Room rents : basic room 1000, Luxury room charges: 4000, Suits charge: 12000.

2.4 The various stock and cash controlling methods

The various methods to control stock are:

- Minimum Stock level: This is also known as Re order level. In this we determine a minimum stock level of our stock and an order is placed when the stock reaches that pre determined minimum level of stock.

- Just in Time (JIT): It is one of the system of controlling stock by keeping in the store of the organization only the minimum stock level and thus, reducing the costs. When the stock goes below the minimum level it is ordered from the suppliers, associating risk factor with it of delay in availability of stock. (Lucey, 2008).

- Economic Order Quantity (EOQ): As it is consists of complexities in calculating the EOQ of the companies so, the companies usually used the software to get it calculated. It balances the stock of the companies by determining the correct stock so that they get rescued from holding too much stock and too little stock.

- First in First out: This system of controlling stock makes sure that the stock is properly procured in a systematic manner specifically perishable stock, so that the stock which was firstly purchased by the company is utilized first and can’t be wasted.

The Cash controlling methods are:

- Better internal control A better and stringent internal control system in an organization helps in the control of the most liquid and the easily convertible asset of the company from being stolen or embezzled. (Atrill, 2011).

- Bank reconciliations: Cash balance should always be reconciled with the bank statements so as to create a check on the theft of the cash.

- Voucher system: In this system it is ensured to reduce the doubling of the transactions by checking every aspect of transaction and documenting it to ensure that all payments must be made only once and thus, every transaction the organization have the evidence.

- Electronic funds transfer (EFT): By using the system of EFT an organization behaviour tends to increase the usage of its people of PayPal which not only not only helps the people to transfer their funds electronically but also generates evidence which shows the details of when the transaction was made and with whom. It also minimizes the number of people involved in usage of the cash.

Task 3

3.1. Determination of variances

(a) Calculation of direct material price Variance:

= (Actual Qty x Standard Price) – (Actual Qty x actual Price)

= (26400*13) – (26400*12.75)

= (26400*13) – (26400*12.75)

= 6600 Favorable

Calculation of direct material Usage Variance:

= Standard Quantity x Standard Price - Actual Quantity x Standard Price

= (24000*13) – (26400*13)

= 31200 Adverse

(b) Calculate the direct labor rate variance:

= Actual hours * standard Rate - Actual hours * Actual rate

= (40200*4) – (40200*4.20)

= 8040 Adverse

Calculate the direct efficiency variance:

= Standard Hours x Standard Rate - Actual Hours x Standard Rate

= (39600*4) – (40200*4)

=2400 Adverse

(c ) Possible reasons of these variances:

The favourable Material price Variance of £ 6600 might be due to any of the following reasons:

- Price decrease

- Proper availability of caviar in the market

- Price is set high for the standard material

The adverse Material Usage Variance of £ 31200 is due to:

- increase the cost due to increasing use of de-meritorious goods.

- Employing inexperienced employees causes excessive waste of material

- no availability of experienced labour also increases the cost.

- Usage of faulty machines and carelessness.

- Embezzlement of material.

The Adverse Labour Rate Variance of £ 8040 may be because of the following reason:

- Due to non availability of the workers and labours in the market the suppliers tend to charge high rate above than the standard for the same workers causing in adverse labour rate variance.

The adverse Labour efficiency Variance of £ 2400 is due to the following reasons:

- Use of inexperienced workers causing the inefficiency

- Due to deliberate restriction, lack of training, or sub-standard material used the efficiency of labours get reduced.

3.2. Financial statement- structure and other variables

(a) The source and structure of trial balance:

Trial Balance: The trial balance is formed during the end of the accounting period when all the ledger accounts are balanced. They can also be prepared as and when needed by the organizations but the balances of the accounts are not available all the time. So, it is usually prepared at the end of accounting year. The objective before the preparation of the Trial Balance is to check the mathematical arithmetical accuracy of the balances. Once it is prepared then the Profit and Loss account and the Balance sheet is prepared. The major vents of information for Trial balance are:

- The Journal books, along with the necessary supportive documents that support the entries made in the journal

- Ledger books along with their compiled accounts, entries, and final balances (Atrill and Mclaney, 2011)

Structure of Trial Balance: As the structure and format of the Balance Sheet and the Profit and loss account is fixed by the accounting law and schedules, similarly the structure and the format of Trial Balance is also fixed by the accounting laws.

XYZ Company

Trial Balance as on 31st March 20XX

|

Particulars |

Debit (£) |

Credit (£) |

|

Share Capital |

|

|

|

Long term Debts |

|

|

|

Trade payables |

|

|

|

Furniture & fixtures |

|

|

|

Inventory |

|

|

|

Trade receivables |

|

|

|

Prepaid expenses |

|

|

|

Cash and cash equivalents |

|

|

|

Sales |

|

|

|

Cost of goods sold |

|

|

|

Expenses |

|

|

|

Incomes |

|

|

|

Total |

|

|

(b) Budgetary Control Process and how it helps management

Budgetary control: It is a system of control where the actual income and the actual expenses and spending of the organizations are compared with the planned income and expenses, so that it can be checked that whether the plans are being followed, and if not being followed then to make changes in order to meet the goals and make profit (Secrett, 2010).

Budgetary Control consists of the following seven steps:

- Communicating Responsibilities

- Explaining Action Plans

- Adherence to the goals

- Monitoring the activities

- Correction of the faults

- Approval of the senior management

- Variances

- Stage 1: Communicating Responsibilities: At stage 1 the responsibilities of the managers in regard to the budget policies and goals are communicated to them.

- Stage 2: Explaining Action Plans: Now the action plans on how to achieve those policies and goals in step by step way are explained to them.

- Stage 3: Adherence to the goals: once the goals and policies and the action plan are communicated to them it’s time to execute it adhering to the goals decided.

- Stage 4: Monitoring the activities: When the activities are being performed it is to be monitored precisely so that there is no chance of mistakes. (Secrett, 2010).

- Stage 5: Correction of the faults: if there is a difference between the actual and the planned income and expenses, measure are taken to correct those differences and to fill the gap.

- Stage 6: Approval of the senior management: Any difference from the budget are only permitted if they have been approved by senior management.

- Stage 7: Variances: If any of the variances or the difference is still remained as it is then they are to be checked and worked upon.

How Budgetary Control helps management:

- Coordinating: It helps the management to coordinate the different activities in course of achieving the goals.

- Communicating plans: The budgetary policy helps the management to communicate their goals and objectives to be worked upon.

- Motivating: It helps the business management to motivate the employees on to achieve the goals correctly and in timely manner.

- Evaluating: It helps the management by evaluating as , if the gaps and differences between the planned and the actual income are least it means they are performing well.

(c ) Usefulness of the Business Accounts

- Owners and Managers: Business accounts are the only documents to help the various users of the financial statements in their decision making process, either they are internal or external users. Its like a report card of the company as it summarizes the financial performance of the business at one place. It helps the owners and managers of the business to take decisions regarding the growth and increasing profit and other managerial decisions and other corrective actions.

- Investors and Creditors: They are one of the most vital users of the statements as the business accounts help them to know about the financial health of the organization so that they can decide whether to continue to invest in that business or not.

- Other Users: Various other users are also keen to know about the financial performance and condition of the company through the business accounts such as employees and labors so that they can find out the information about the salary and other form of compensation.

Significance of notes to accounts: The financial statements of any organization are the only way for the organization to communicate to its users and stakeholders about their performance and growth. Thus, it a very vital information document which contains vital information and which is going to affect the company’s future growth as every user like investors and shareholders are going to rely on it. Thus, it should be truly correct. And to make it correct and to explain each and every details of the financial statements notes to accounts are used. Notes help in showing that whether the companies had sticked to their consistent accounting policies or not. And if not they what is the reason for the deviation? Is it under the regulations or not? Is it enhancing the presentation or it’s the legal requirements? (Atrill and Mclaney, 2010).

Task 4

1. Calculation of ratios and analysis thereof

One of the most important ways of understanding the organizations performance is analysis of the competitors and the industry. Analysis of industry and organization is done by numerous scientifically established methodologies out of which ratio based analysis holds the maximum weight age (Dowd, 2002). A ratio based analysis depicts relationship existing amongst operational and functional variables of a business organization. In order to perform a similar evaluation of our entity we have undertaken a ratio based analysis of a similar hotel operating in the industry. The ratios used for the analysis are,

- Gross Profit Margin: Gross profit margin depicts the relationship between the profits generated out of operations in relation to the sales. Gross profit margin is a very important variable in analyzing the operational efficiency of the organization. The gross profit margin for the hotel has been,

= For 2002 - {(1, 82,530-1, 53,730) / 182530} * 100

= 0.1578 or 15.78%

= For 2003 – {(2, 05,157 – 1, 72,065) / 205157}*100

= 0.1613 or 16.13%

Where, Gross Profit = Turnover – Cost of Sales

- Stock Turnover: This ratio depicts the efficiency of the organization in consuming its supply of goods in number of times. A lower turnover is a depiction of poor sale efficiency and hence piles up of stock. The Stock turnover ratio for the organization is,

= For 2002 – (153730 / 11862)

= 13times (approx)

= For 2003 – (172065/12,482)

= 14 times (approx)

- Debtors Collection Period: Debtors collection period depicts the relationship between the debtors of the organization and the revenue/turnover generated. This ratio in actual depicts the time taken by the organization to recover its locked up funds from the debtors. A lower is always better. This ratio for the organization stands at,

= For 2002 – (28410/182530)*365

= 56.81 days (approx)

= For 2003 – (32287/205157)*365

= 57.44 days (approx)

- Creditors Payment Period: Creditors payment period is the relationship between the money the organization owes to its creditors and the cost of sales for achieving the turnover. This ratio depicts the time taken by the organization to pay-off its debt. Higher this ratio shows a good creditor management power in the organization’s capacity.

This ratio for the organization for the period under consideration is,

Total Purchases = Sales - Gross Profit +Closing Stock

Creditor Payment Period 2003 = 205157-33092+12482 = 184547

Creditor Payment Period 2002 = 182530-28800+11862

= 165592

Average Payment Period = total creditor / credit purchase x 360

Average Payment Period 2003 = 17048+13388 / 184547 x 360

= 30436 /184547 x 360

= 59 days (approx)

Average Payment Period 2002 = 13585 + 6870 / 165592 x 360

= 44 days (approx)

4.2. Suggested future management strategies

After conducting a brief analysis the important ratios for the business as computed above. We may easily derive the following conclusions and the suggested measures for tackling the same,

- The future management strategies must include proper cash flow management inside the organization.

- The management must follow new procedure and techniques to attract new customers for the organization so as to enhance the sales level by providing various discounts and sales promotion schemes.

- Effective use of the non-current assets becomes very essential if the organization wants to generate the revenue from the same.

- Management strategies in relation to the business and service operations must includes longer credit periods after negotiating with the customers and in contrary shorter credit period must be allowed to the customers.

- Management must avoid unnecessary allocation of the funds on inventories and at the same time it must be reduced. The management must follow JIT system of inventory stock system rather than EOQ inventory system.

- The management must look for some initiative steps to increasing the selling prices as well as volume of sales.

- Proper strategies must be implemented for reducing the unnecessary expenses as well as avoidance of the same.

- It may be seen that the hotel’s gross profit has been increasing year on year and, the gross profit margin has also been rising in the fiscals under review this considerably shows a good expense control mechanism been used in the hotel. Howsoever, a better operational expense control will help the organization to retain further profits for its purpose.

- Stock turnover ratio is a measure that depicts the efficiency of an organization in utilizing its supply of goods certainly because of a better sales team in force and thus raising higher revenues by sales. Howsoever, a lower ratio is an indicator of poor sales team. Hotel’s stock turnover ratio is seen to be rising year on year and this certainly shows a good effort towards better sales turnover. This should be further continued and in fact more stress should be given in further amplifying organizational sales forces.

- Amount locked in debtors i.e. not received from debtors is a loss of opportunity and is an opportunity cost for the organization thus debtor’s collection team should be efficient for assurance of a better liquidity management, in form of less amount being locked up with debtors. It has been seen that the debtor’s collection period for the hotel has risen over the year and is certainly not advisable in sight of better risk and funds management. Thus, the management should reinforce its credit terms to ensure lesser funds are locked in with debtors.

- Creditors are the parties to whom the business owes money, extended credit periods helps the firm in form of more funds being available with the entity. A higher creditor payment period is thus, favorable. It is an indicator of the entity having a good marketing relationship with creditors. The hotel’s credit payment period has positively risen over the years under review.

Task 5

5.1 Categories costs as fixed, variable and semi-variable for a given scenario

Fixed Cost: Those cost which does not with the change in the production and remains constant are known as fixed cost. The example of fixed cost is rental charges, electricity charges.

Variable Cost is defined as the cost which changes with the level of output and activity .It doesn’t remain fixed neither in short run neither in the long run .Example of variable cost is direct material cost and labor cost .

Semi Variable Cost is also termed as mixed cost that has the features of fixed cost and variable cost. The example of semi variable cost are telephone bill which is fixed at some time and variable sometimes.

References

Hussain, A (1989). A textbook of business finance, East African Publishers

Lacy,R.H (2001).Financing your business, Made E-Z publishers

Holtz, H(1983). 2001 sources of financing for small business, University of Michigan, Arco Publishers

Dowd, K (2002). An introduction to market risk measurement, Wiley Publishers.

Lucey, T. (2008). Costing. 7th ed. Cengage Learning

Atrill, P. (2011). Financial Management for Decision Makers. 6th ed. Financial Times/Prentice Hall

Atrill,P. & Mclaney, E. (2010) Accounting and finance for non specialists.7th ed. Financial Times/Prentice Hall

Drysdale, A (2010) The financial Controller. Management Books 2000 Limited

Secrett,M. (2010) Brilliant Budgets and forecasts. Pearson Business

Vogel, Mintel (2010), http://www.goodfellowpublishers.com/free_files/Chapter%2010-f5d89c30697d8d2cdaed6b944079ed3f.pdf (Accessed on 16th November 2014)

Need Help with Your Assignment?

Get expert guidance from top professionals & submit your work with confidence.

Fast • Reliable • Expert Support

Upload NowDetails

Other Assignments

Other Solution