- support@locusassignments.com

Unit 1 Demand Supply in Business Environment Assignment

|

Program |

Diploma in Business |

|

Unit Number and Title |

Unit 1 Demand Supply in Business Environment |

|

QFC Level |

Level 5 |

Introduction

This task explores the intricate dynamics of the business world, most notably in the way the dynamics of demand and supply shape organizational conduct. First, Primark will be recognized as a pioneering organization in the private sector, and its final goal will be examined. This will also explore the extent to which Primark is accountable to the goals of its diverse stakeholders and map out the company's role and the strategic manner in which it attains them. Second, the analysis will examine how various economic systems try to provide effective resource allocation, as well as an assessment of the extensive influence that fiscal and monetary policies exert on businesses and organizational activities, particularly in the United Kingdom.

Task 1: Organizational Forms, Objectives, and Stakeholder Involvement

1.1 Identifying and Investigating Organizational Forms and Objectives

Primark, Ireland's leading clothing retailer, is largely a private sector enterprise. Its main aim is to retail high-quality products at affordable prices, and to be a responsible and customer-focused organization. Apart from profitability, Primark is determined to be serviceable to customers and employees.

Let us talk about why organizations of different kinds exist:

The Public Sector – National Health Service (NHS): Located in London, United Kingdom, the NHS ranks among the most central public sector institutions. Its central role is to provide an environment and conditions to facilitate high-quality health and care services. The NHS is committed to making effective use of valuable public resources in a manner that produces the best possible outcomes for people, communities, and society, hence the benefit of both the present and future generations. (According to research carried out by the Bank of England and the IMF, public sector institutions like the NHS are central elements of the UK's mixed system of economics and are directly exposed to the government's policies, providing valuable public goods and services.)

Charity – The British Red Cross Society: Being a well-entrenched charitable organization with a considerable number of volunteers and employees, the British Red Cross Society is committed to humanitarian work. Its objective involves implementing relief programs to help victims of disasters while engaging in developmental activities as well. This dual approach sustains humanitarian values, improves disaster response and preparedness, and enhances health and community services. Their work is focused on preventing deaths, injuries, and disasters and disease aftermaths, encouraging respect for diversity, human dignity, and against intolerance, discrimination, and social exclusion. (Charitable organizations play a crucial role in addressing the needs of society, often complementing government services, as is elaborated in deeper studies on corporate social responsibility.)

Cooperative – The Cooperative Bank: This United Kingdom commercial and retail bank is the embodiment of the cooperative model. Its mission is to promote a banking philosophy that benefits the lives of its customers and the communities it operates in, within the premises of mutual benefit and ethical practice.

1.2 Examining Primark's Fit with Stakeholder Goals

Primark tries to meet the different goals of its many stakeholders by utilizing an encompassing strategy:

Investors are more concerned with investment risks, current interest rates, and net returns earned. They require timely and unambiguous information for well-informed decisions regarding buying, retaining, or selling shares. Primark's focus on profitability and stability helps meet such needs by providing significant financial information for the establishment of dividends. (For a better understanding of investor expectations and corporate governance, reference materials presented by the Corporate Finance Institute in the context of corporate structures and financial systems are most apt.)

Primark caters to employee expectations by offering competitive compensation, incentive pay based on performance, and facilities for a safe and welcoming work environment. Employee well-being is given importance to improve productivity and reduce staff turnover.

Lenders have a special concern with collateralization of their loans and trade credits. Primark mitigates this risk by demonstrating lasting financial stability and making timely payments through the use of proceeds from sales.

Suppliers are in need of assurance that their supplies and trade credit are secure. Primark ensures good relations by timely payment of services and products bought.

Customers/Clients: Customers keep an eye on Primark's market position and commitment. Primark maintains customer interest through ongoing business expansion and, provision of attractive products and services.

Government Institutions: Primark is involved in government schemes relating to the allocation of resources within the business regulatory patterns by paying tax, which is a part of national income. (The Bank of England and the International Monetary Fund publish papers from time to time commenting on the interaction between businesses, taxation, and national income, and the role of private business in public finance.)

Primark contributes positively towards public interest by creating employment opportunities that indirectly support the development of the national economy and the general framework of society. The organization also creates local suppliers and provides quality experience in various market dynamics and overall efficiency.

1.3 Elucidating Primark's Responsibilities and Strategies for Success

Primark as an organization owes a certain number of responsibilities to its stakeholders and employs effective strategic techniques to keep their interests in mind, anticipating any conflicts and ensuring objectives are met. Issues of different stakeholders regarding Primark's responsibilities are:

Staff: Being a retail business, Primark is obliged to provide good working conditions and a proper payment system to its staff. This is according to Corporate Social Responsibility (CSR) standards based on fair labor practices.

Shareholders: Primark is duty-bound to its shareholders to maintain profitability and distribute dividends regularly.

Governmental Institutions and Government: Among other responsibilities, Primark has the responsibility to allocate the right resources, provide employment solutions, comply with domestic business laws, and remit corporate taxes promptly. This illustrates the impact of fiscal policy on business firms since governments use corporate taxes to fund public expenditure, as discussed in the literature on the effect of fiscal and monetary policy on firms.

Customers: It is one of the key responsibilities of Primark to provide the best products and services of the highest quality at the lowest prices possible, and thus bring about customer satisfaction and loyalty.

Apart from these clear commitments, Primark needs to embrace new ideas in the field of Corporate Social Responsibility (CSR). The creation of a strategic plan includes the correct perception of the projected future situation. The strategic factors that Primark needs to deal with to achieve its own specific goals are the creation of short-term objectives, ensuring operational accuracy, and sharing profitable outcomes with all stakeholders. A vision-driven approach includes the creation of a sustainable vision and interaction with long-term advantages for all shareholders.

The strategic improvement process includes constantly refining Primark's strategy, developing competitiveness through interaction with every stakeholder, and facilitating organizational strategies through its human resources. (For more comprehensive analysis of the dynamic CSR environment, existing trends and integrated frameworks are available in academic and industry literature on recent developments in corporate social responsibility.)

Contact us

Get assignment help from full-time dedicated experts of Locus assignments.

Call us: +44 – 7497 786 317

Email: support@locusassignments.com

Task 2: Economic Systems and Policy Impacts

It can be seen that different countries have different economic systems to effectively allocate resources. An economic system is made up of the resources used for the planning and stimulating production, distribution, and exchange of goods and services. Typically, there are three types: market economy, centrally planned economic system, and mixed economic system. (A thorough explanation of the systems is found in sources like the Corporate Finance Institute's "Economic System - Overview, Types, and Examples" and Britannica's "Economic system.")

Market Economy: In a market economy, investment, production, and distribution decisions are made by market-determined demand and supply. Products and services are mainly determined by a free price mechanism, by the collective actions of individual citizens and businesses. Government intervention is minimal. (To see how free markets work, Investopedia's supply and demand resources are invaluable.)

Centrally Planned Economic System: In this system, the state or government makes most of the economic decisions rather than individual consumers and companies. What to produce, how to produce, and at what price are controlled by the state.

Mixed Economic System: This system combines elements of market forces and economic planning, as well as both public and private ownership systems. It safeguards individual property rights and provides some freedom in the use of capital, but still allows government interference in economic affairs to achieve social goals. The United Kingdom is a mixed economy, with private enterprise and public goods, as a concept discussed by SNHU and BYJU'S in their study of economic systems.

Let's take the economic systems of China, the United Kingdom, and Cuba:

The Cuban economy is centrally planned. Unemployment is not generally a serious problem, considering the fact that the state organizes and directs almost all economic activity and resource allocation.

United Kingdom: The United Kingdom possesses a mixed economic system. It has both private and public price mechanisms within this system. This provides flexibility, in that if one economic mechanism proves to be poor, others can be used to ensure overall economic balance. (The operations of the Bank of England and the fiscal policy of the Chancellor of the Exchequer are the best examples of the UK's mixed economic strategy, in which there is extensive government and central bank intervention in the market.)

China has a unique combination of socialist ideals along with a capitalistic market economy. Unlike most of the Western world, the majority of Chinese firms are state-owned, and the state holds a great deal of regulatory power over private firms, directing market forces to national objectives.

2.2 Assessing the Impacts of Monetary and Fiscal Policy on Businesses

In the UK, the fiscal policy is implemented by the Chancellor of the Exchequer, and the monetary policy is implemented by the Bank of England. These organizations have a direct influence on various business segments. (For better comprehension, the IMF and Bank of England's official reports on monetary policy are good sources to refer to.)

Impacts on Agriculture:

Cash Flow Impacts: Real estate typically constitutes the bulk (about 80%) of farm assets. While land incomes can equal inflation, capital gains are earned only upon the sale of the land. Farmers can finance cash flow deficits using money borrowed against capital gains. Runaway inflation can create enormous deficits in early years and increased surpluses later, leading to investment as a strategy for survival.

Real Wealth Effects: Farmers were once helped by inflation since they were net debtors whose long-term interest rates tended to be lower than the inflationary rate. This caused the real value of their debt to fall over time.

Effects of Instability: Use of flexible interest rates, increasingly used to cope with inflationary instability, reduces the transfer of real wealth from borrowers to lenders. But, as in the case of flexible exchange rates, these interest rates have the potential to add to the short-run instability of the agricultural sector in the economy. (These effects are dealt with well in economic literature on the effect of monetary and fiscal policy on enterprises, especially for capital-intensive industries.)

Impact on Housing:

Fiscal Policy Impact: The government's fiscal policy affects aggregate demand directly and indirectly by complex multiplier effects and feedback loops. Aggregate demand changes can, in turn, influence disposable personal income, income distribution, employment, and price levels. Policymakers can control aggregate demand by raising or lowering government spending on transfer payments (social security, Medicare, unemployment benefits) or by buying goods and services. Aggregate demand changes will induce changes in housing starts.

The impact of monetary policy: Monetary policies that are aimed at increasing the supply of money within an economy lead to the lowering of interest rates. Lowered interest rates stimulate higher consumption and investment activities. In the housing market in particular, a decrease in interest rates translates to cheaper borrowing for housing, hence increasing the demand for housing since mortgages are now affordable. (The interaction between interest rates, money supply, and housing demand is a general phenomenon explained by organizations like the International Monetary Fund and the Bank of England in their monetary policy analysis reports, which are outlined in their respective Monetary Policy Reports.)

2.3 UK Competition Policy and Regulatory Mechanisms

Competition is required for the proper functioning of the market. But unequal sizes of companies can create unequal competition. In the UK and Europe, there are competition policies enacted to guarantee and enhance competition so that consumers benefit. (Find out more about competition law, particularly antitrust, on Investopedia's "Antitrust Laws" page.)

The following are three of the key competition policy and regulatory tools of the UK:

1. Antitrust Laws cover two general subjects:

2. Arrangements between firms that limit competition (e.g., price-fixing or market division).

3. Abuse of market dominance (for example, trying to drive out competition by practicing predatory pricing practices).

The national regulators of the UK have been 2004 given the authority to enforce EU rules, specifically in the case of intra-common market trade between member states.

Mergers: When mergers concern players such as Tesco generating revenues above a certain level, they can be examined by the European Commission and, after Brexit, the United Kingdom's Competition and Markets Authority (CMA). A merger can be prohibited or restricted when it largely eliminates competition and has a detrimental impact on consumers. To illustrate, Tesco can adopt certain measures to minimize the problem of decreased competition, and these can include granting a license to some other player for the utilization of its technological aspects so that exclusion is not triggered. (One should comprehend the complexities of mergers and acquisitions, and their regulatory oversight, to comprehend market structures such as oligopoly and duopoly.)

Cartels: Illegal clandestine agreements between rivals to fix prices or quantities, cartels are prohibited by EU and UK competition law. To uncover clandestine cartels, enforcement agencies will typically provide incentives (e.g., "no-fine" policies) to the initial cartel member to come forward (be a whistle-blower). (For more information on why cartels are illegal, see academic literature or legal descriptions of competition law.)

State Aid: EU Treaty law (and now similar UK law) generally prevents national governments from providing unfair aid to specific industries, e.g., the supermarket industry (e.g., Tesco), by way of subsidies or other forms of financial advantage which disadvantage competition.

Market Reviews: The UK's Competition and Markets Authority (CMA) can carry out detailed reviews of whole markets where it finds competition concerns that are detrimental to consumers. This can result in recommendations for industry structure or regulatory changes. (This process guarantees continued fairness and protection of consumers from anti-competitive behavior.)

Task 3: Market Structures and Organizational Responses

3.1 Explaining Pricing and Output Decisions in Market Structures

Perfect Competition: It is a market condition with many buyers and sellers trading homogeneous commodities. The price of a good under perfect competition is established at the intersection of the demand and supply curves, i.e., the equilibrium point. Here, the quantity demanded is equal to the quantity supplied at an equilibrium price and quantity remaining. A local farmer's market would be an example. (An intuitive idea of the same can be gathered from articles explaining the Theory of Demand and Supply.)

Monopoly: A single firm has the entire market in a monopoly. The monopolist treats the market demand curve as its demand curve and is a price maker. But it cannot charge a price that consumers are unwilling to pay. A monopolist possesses market power and can raise prices above the marginal cost without fearing new entrants to capture supernormal profits. An example frequently used in a public service context is the NHS as a quasi-monopoly provider of health care services in the UK, though this is a flawed example based on its public finance and social mission. (For a comprehensive appreciation of monopoly conduct, see detailed economic descriptions of market structures.)

Oligopoly: Prices in oligopoly markets create interdependent prices, wherein some firms at times overlook their interdependence or fight price wars. Under price leadership, prices are set by one giant firm and followed by others. These markets are prevalent in the automobile sector and steel sector, wherein a couple of giant players are dominant. (Investopedia's article on Oligopoly: Meaning and Characteristics in a Market is worth reading.)

Duopoly: A duopoly is a specific type of oligopoly where two giant brands control most of the product being sold, significantly influencing selling conditions. If perfect substitutes are price competitors, the more efficient firm with superior goodwill and more influential clientele might drive the other out of business, and the outcome could be a monopoly. The Reuters and Associated Press are exemplary cases in the news wire service industry. (For further information on duopolies, Investopedia's Duopoly: Definition in Economics, Types, and Examples is an acceptable reference.)

3.2 Demonstrating How Marketplace Forces Influence Organizational Reactions

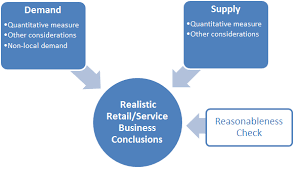

Demand and supply forces are significant economic factors that have a significant influence on the way organizations respond. Supply refers to the amount of products and services that exist within the market, and demand refers to the amount that customers desire. (Demand and supply action is an underlying principle, explained in texts such as the IMF's "Supply and Demand: Why Markets Tick.")

In a market economy, the price per unit of a product, like those of Tesco, will vary until it is at a level where the quantity demanded by consumers equals the quantity supplied by producers. This is a state of economic equilibrium in price and quantity.

An increase in demand for a certain good offered by Tesco, without a change in supply, results in a higher equilibrium price and quantity.

On the other hand, if the demand for a Tesco product declines without any change in supply, it leads to a reduction in equilibrium quantity and price.

When the supply of a given Tesco product rises, but demand remains constant, this will lead to a fall in equilibrium price and an upward movement in quantity.

Finally, if the amount supplied of a particular Tesco product decreases while demand stays constant, this will cause an increase in the equilibrium price as well as a decrease in quantity.

Tesco, like any company, will look to achieve a state of equilibrium where demand equals supply, with the state being the most ideal market condition. Price is a simple tool to capture both demand and supply conditions.

For instance, if Tesco lowers the price of a specific product, it becomes more financially attractive to more and more customers, thereby expanding the overall market for the product. Because of the fact that Tesco is operating in a very competitive market, pricing can be used tactically to gain and maintain market share. (The dynamics of pricing strategies and market forces are discussed in depth in most of the economic and business management literature.)

3.3 Assessing Business and Cultural Environments' Impact on Organizational Behavior

The operational and cultural context strongly influences the behavior of an organization such as Tesco. A PESTLE analysis offers a general framework for examining these factors:

Political (P): Since Tesco is a global company, political situations across the globe significantly affect the company's performance. They encompass taxation rates, laws, and political stability of the nations in which the company is present. Tesco operations help in generating jobs, generating product demand, and building a multiskilled workforce. (Political stability and government policies are major concerns for global firms, usually specified in country-specific business environment reports.)

Economic (E): This is an essential consideration for Tesco because it has a direct impact on costs, demand, profitability, and prices. The company has to stay up to date with any policy changes, e.g., taxation, that can affect its survival. While Tesco diversified outside the UK, it is still heavily reliant on the UK market. (The Bank of England's Monetary Policy Reports and the IMF's economic outlooks offer very good information on the economic forces affecting UK business.)

Social (S): UK consumer behavior is moving towards one-stop and bulk shopping. To counteract this, Tesco has enhanced the level of non-food products available for sale. Further, as consumers are becoming increasingly health-conscious, Tesco has enhanced its focus on organic food to meet emerging needs. (It is necessary to comprehend social trends and consumer behavior in the retail strategy, normally discussed in consumer studies and marketing.)

Technology (T): Technological advancements have played a significant role in designing and implementing services such as home delivery-facilitated online shopping. Furthermore, self-service checkouts enhance customer convenience and accessibility while, at the same time, minimizing the labor cost for the firm. Technology's influence on the efficiency of retail processes and customer experience is widely researched in the business innovation field.

Legal (L): Tesco is directly impacted by government legislations and policies. To facilitate compliance and enhance customer value, Tesco can offer discounts on specific items based on customer spending in their food stores by promotion rules and consumer protection legislation. (The UK competition policy mechanisms previously discussed, such as antitrust and merger rules, are the best examples of legal considerations on large retailers such as Tesco.)

Environmental (E): Tesco is plainly committed to reducing its carbon impact, with ambitious goals like a 50% reduction having 2020 as a target. Additionally, the company attempts to reduce waste output in company stores and does its best to spur social awareness in customers in the direction of environmental sustainability. (Corporate environmental efforts are a key part of modern-day Corporate Social Responsibility (CSR), with many companies even having targets and reporting progress.)

Task 4: Global Factors and EU Impact on UK Business

4.1 Discussing the Significance of International Trade to UK Business Organizations

International business is particularly crucial to business firms operating in the United Kingdom, like Tesco, primarily due to the doctrine of comparative advantage. Comparative advantage asserts that economic trade between two countries can be beneficial to both if one country possesses a relative efficiency in the production of some goods required in exchange.

Apart from comparative advantage, international trade has several benefits:

Capital Transfer: It facilitates the transfer of capital at low cost, thus encouraging long-term sustainable business development.

Job Opportunities: International trade creates avenues for increased job opportunities for UK retail firms by stimulating the merging of various cultural elements, thereby enhancing services and customer experience.

Investment Opportunity: It significantly increases the scope for investment, which is crucial to ensure the operational sustainability of a retail business.

Network Building: International trade allows Tesco to build strong and efficient global networks with suppliers, shareholders, workers, and consumers, enhancing its global outreach. (The IMF and World Trade Organization occasionally release reports on the advantages and dynamics of international trade.)

4.2 Examining the Influence of Global Forces on UK Business Organizations

The impact of global forces on business entities in the United Kingdom, as represented by Tesco, can be analyzed in depth through a PESTLE analysis modified to fit an international setting:

Political (P): Given Tesco's global operations, international political dynamics significantly affect its performance. This entails a comprehension of differing tax regulations, legal frameworks, and the general political stability of the nations in which it operates. Tesco's extensive reach not only facilitates job creation and promotes diverse workforces but also requires the management of intricate international trade agreements and associated geopolitical risks.

Economic factors (E): This factor is of primary concern to Tesco globally as it determines cost management, customer needs, profitability, and pricing strategy across markets. The company has to remain extremely sensitive to changes in global economic policy, e.g., changes in global taxation or global trade tariffs, which directly affect its financial viability. In spite of its global outreach, Tesco continues to exhibit an overbearing strategic dependence on the UK market, mediating the twin challenge of internationalization and national stability. (Global economic projections by the IMF and World Bank are critical tools for plotting these implications.)

Social (S): International social trends, including urbanization growth, changes in consumption patterns (e.g., organic or vegetarian products), and differences in consumer expectations across countries, have a direct impact on Tesco's product innovation and marketing efforts globally. Sensitivity to different social trends, ranging from consumer buying habits (e.g., growth in internet shopping) to health awareness, is required in order to thrive internationally.

Technology (T): Technological innovation at a global level has transformed the retail sector. For Tesco, this encompasses investing in online e-commerce websites so that people can order delivery at home online, using self-service checkouts to improve customer convenience and saving labor costs simultaneously. It also applies data analysis for inventory management and creating personalized marketing campaigns in all its operations globally. Sustained evolution in technological innovation is a key global driver that influences all companies, especially the retail industry.

Legal (L): Tesco's international operations require adherence to a range of legal frameworks in different countries, including labor laws, consumer protection laws, antitrust laws, and data protection laws (e.g., GDPR in the EU). Adherence to these disparate legal environments is required to avoid sanctions and maintain a good corporate reputation.

Environmental (E): Global environmental issues like climate change and natural resource depletion have a significant role to play in Tesco's global supply chains and business operations. Its efforts to minimize its carbon footprint and eliminate waste are extended to its global operations, informing all of its sourcing, logistics, and packaging decisions in each market in which it operates. (Global environmental standards and consumer pressures for environmentally friendly practices are increasingly shaping corporate behavior globally, as part of a wider CSR agenda.)

4.3 Evaluating the Impacts of European Union Policies on Business Organizations in the United Kingdom

Despite the United Kingdom's departure from the European Union, knowledge of the historical and long-lasting (albeit altered) effects of EU policies is essential for UK companies such as Tesco, particularly in light of current trade agreements and the continued influence of EU regulation. Before Brexit, EU policies played a major role:

Elimination of Currency Exchange Costs: Before the universal use of the Euro, the reality that different countries in the EU had different currencies meant that companies incurred costs of currency exchange. The creation of the single market and later the Eurozone was meant to eliminate these costs, thus spurring greater cross-border trade and, theoretically, increasing the GDP of member countries by simplifying transaction procedures. (This is relevant to monetary policy discussions, as a common currency reduces exchange rate volatility.)

Growing Competition and Efficiency: The Elimination of currency conversion requirements and the introduction of clear pricing mechanisms in the European Union single market have exerted deflationary pressure on prices for organizations with high operational expenses. This growing competition has compelled companies to enhance their efficiency to survive and succeed.

Reducing Exchange Rate Uncertainty: The shift towards a single currency or fixed exchange rate regimes has facilitated the enhancement of trade relationships between member countries. This has fostered investment by business firms across nations as it offers more confidence in cost and profit analysis by eliminating the need to consider the uncertainty of varying exchange rates. (The reduction in exchange rate risk is a simple advantage of economic integration, which has a direct impact on international trade and investment strategy.)

Regulatory Conformity: EU membership required UK companies to adhere to EU-wide rules, such as those on competition, product specifications, environmental protection, and consumer protection. This gave a level playing field at the bloc level, but at the cost of less freedom for the UK to make its own rules. Now post-Brexit, the UK is creating its own regulatory framework, but most standards remain aligned or "differ" from EU standards, introducing new complexity.

Need help?

Get Complete Solution From Best Locus Assignment Experts.

Conclusion

The research has comprehensively analyzed the business environment by specifically assessing the processes of how price and output decisions are formulated in various market structures, including perfect competition, monopoly, oligopoly, and duopoly. The research has demonstrated how demand and supply forces interactively influence organizational strategies, with cases such as Tesco. The research has also assessed the significant influence of business and cultural environments on organizational behavior through an extensive PESTLE analysis. The discussion also covered the significance of international trade to UK businesses, the pervasive influence of global forces, and a critical analysis of the European Union policies' past and current implications on UK businesses. This integrated perspective emphasizes the complex interaction between internal strategies and external forces typical of the modern business environment.

References

Bank of England. (2025, February 6). Monetary Policy Report - February 2025. https://www.bankofengland.co.uk/monetary-policy-report/2025/february-2025

Bank of England. (2024, September 10). Financial stability at the Bank of England. https://www.bankofengland.co.uk/financial-stability

Britannica Money. Supply and demand | Definition, Example, & Graph. Retrieved https://www.britannica.com/money/supply-and-demand

BYJU'S. Meaning And Types Of Economic System. https://byjus.com/commerce/meaning-and-types-of-economic-system/

Corporate Finance Institute. Economic System - Overview, Types, and Examples. https://corporatefinanceinstitute.com/resources/economics/economic-system/

Imarticus. A Guide to Markets: Monopoly, Duopoly, Oligopoly & Perfect Competition. https://imarticus.org/blog/a-guide-to-markets-monopoly-duopoly-oligopoly-perfect-competition/

International Monetary Fund. Supply and Demand: Why Markets Tick https://www.imf.org/en/Publications/fandd/issues/Series/Back-to-Basics/Supply-and-Demand

Investopedia. (2025, May 1). Antitrust Laws https://www.investopedia.com/terms/a/antitrust.asp

Investopedia. (2024, April 15). Oligopoly: Meaning and Characteristics in a Market. https://www.investopedia.com/terms/o/oligopoly.asp

Investopedia. Duopoly: Definition in Economics, Types, and Examples https://www.investopedia.com/terms/d/duopoly.asp

Mailchimp. Understanding Supply and Demand in Business https://mailchimp.com/resources/supply-and-demand/

Only IAS. Types Of Market Structures: Perfect Competition, Monopoly, Oligopoly, Monopolistic Competitionhttps://pwonlyias.com/udaan/types-of-market-structures/

PWOnlyIAS. Types Of Economic Systems And Sectors 2023: Definitions, And Comprehensive Real-World Examples https://pwonlyias.com/types-of-economic-systems-in-india/

SNHU. Understanding the Types of Economies and Economics Around the Globe. https://www.snhu.edu/about-us/newsroom/business/types-of-economies

Testbook. Demand & Supply: Meaning, Factors, Types, Law|Economics Notes! https://testbook.com/ias-preparation/economics-demand-and-supply

Author Bio

Dr. Dracey M. is an experienced Business Environment Analyst with 10+years of expertise in economic policy, market dynamics, and corporate strategy. With a strong focus on the UK context, he consistently provides insightful analyses of demand-supply interplay, fiscal policies, and global factors shaping organizational behavior.

Need Help with Your Assignment?

Get expert guidance from top professionals & submit your work with confidence.

Fast • Reliable • Expert Support

Upload NowDetails

Other Assignments

Related Solution

Other Solution